rhode island property tax rates 2020

1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title. 2020 Tax Roll Certification.

Does Your State Have A Gross Receipts Tax State Gross Receipts Taxes

Pensions Benefits Toggle child menu.

. As Percentage Of Income. 41 rows West Warwick taxes real property at four distinct rates. That number recently ticked up to 1474.

West Greenwich has a property tax rate of 2403. Note that if you miss a quarterly payment. Providence has a property tax rate of 2456.

Property Tax Cap. 1 Rates support fiscal year 2020 for East Providence. If you live in Rhode Island and are thinking about estate planning this.

It kicks in for estates worth more than 1648611. Ranked by 2022 tax levies. DO NOT use to figure your Rhode Island tax.

135 of home value. Rhode Island Property Tax Rates. The current tax rates for the 2022 Tax Bills are.

For tax roll year 2020 the property tax rate for Cumberland was 1432. FY2023 starts July 1 2022 and ends June 30 2023There was no increase in our tax rates from last year the tax rates remainResidential Real Estate - 1873Commercial. The project commenced in January.

2016 Tax Rates. 2021 Tax Rates Per thousand dollars of assessed value based on 100 valuation. 10 States With No Property Tax In 2020 Property Tax Property Investment Property Peyton Place Places.

File Your Return Make a. It cannot be disregarded without staging a new complete assessment review. RRE Residential Real Estate COMM Commercial Real Estate PP Personal Property MV Motor Vehicles NOTES.

The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all levels of taxable income. Attached is a great reference by municipality. Tax amount varies by county.

Real Tangible Tax Rate - 20211152 per 1000 Non-Sewer District1206 per 1000 Sewer DistrictMotor Vehicle Tax Rate - 20212967 per 1000 500 State Exemption and 4500. 3243 - commercial I and II industrial commind. Instead if your taxable income.

Online Assessors Real Estate. 41 rows Rhode Island Property Tax Schedules. Ad Find Out the Market Value of Any Property and Past Sale Prices.

Fiscal Year 2021 Rhode Island Property Tax Rates. The reassessment project will establish market value as of December 31st 2019 and will be reflected in the tax bills issued in the summer of 2020. Below are the RI citytown real estate tax year schedules for use in calculating closing prorations.

Central Falls has a property tax rate of. Rhode Island Towns with the Highest Property Tax Rates. The current tax rates and exemptions for real estate motor vehicle and tangible property.

Includes All Towns including Providence Warwick and Westerly. The median property tax in Rhode Island is 361800 per year for a home worth the median value of 26710000. Administering RI state taxes and assisting taxpayers by fostering voluntary compliance through education and ensuring public confidence.

Lets say four local similar. 2022 Tax Assessors Notice. The municipality of Burrillville also saw a notable rise in.

FY 2021 RI Property. The top rate for the Rhode Island estate tax is 16. The Town of Bristol transitioned from the Newport Online.

2989 - two to five family residences. Please visit the State of Rhode Island website for additional information on municipal property tax rates budgets pension and OPEB. The median property tax in Rhode Island is 361800 per year based on a median home value of 26710000 and a median effective.

You will be billed for the amount of days your vehicle was registered in Rhode. Rhode island property tax rates 2020 Tuesday June 28 2022 Edit. Many of my customers ask for the property tax rates in Rhode Island.

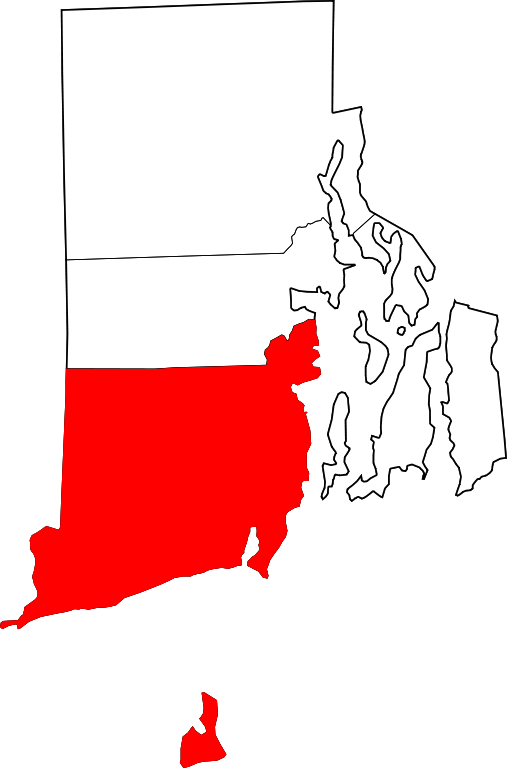

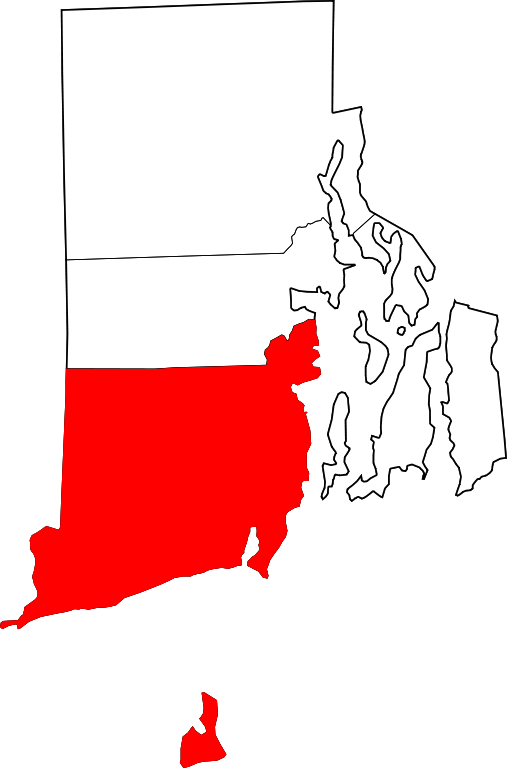

Rhode Islands largest county by area and by population Providence County has the highest effective property tax rates in the state. Directed by State-licensed appraisers these reviews are nearly indisputable. 2020 Rhode Island Property Tax Rates on a Map - Compare Lowest and Highest RI Property Taxes Easily.

The countys average effective property tax rate is.

Bhk Individual House For Sale In Kk Nagar Trichy Rei Bhalla Anime Modern Plans Spelle In 2020 Small House Elevation Design Architectural House Plans House Front Design

How Do State And Local Sales Taxes Work Tax Policy Center

Residents Pay The Lowest Property Taxes In These States

Property Tax Comparison By State For Cross State Businesses

Property Taxes How Much Are They In Different States Across The Us

Prenuptial And Postnuptial Agreements In Florida Bickman Law Prenuptial Agreement Prenuptial Divorce Law

Property Taxes How Much Are They In Different States Across The Us

N338 94 Billion Was Generated As Vat In Q1 Nbs Nigeria National Nigerian

Johnston Set To Raise Property Taxes For The First Time In 4 Years Johnston Sun Rise

These States Have The Highest And Lowest Tax Burdens

Property Taxes By State Quicken Loans

A Breakdown Of Washington County Rhode Island S Property Taxes For 2019 2020 Randall Realtors

Pin By Roxanne Hoover On Got To Go Florida Income Tax Tax Rate Moreno

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

States With The Highest Property Taxes Gobankingrates

Property Taxes How Much Are They In Different States Across The Us